Mortgage Rate Forecast

Geopolitical uncertainty is causing mortgage rates to drop. Windermere Chief Economist, Matthew Gardner, explains why this is and what you can expect to see mortgage rates do in the coming year.

Over the past few months we’ve seen a fairly significant drop in mortgage rates that has been essentially driven by geopolitical uncertainty – mainly caused by the trade war with China and ongoing discussions over tariffs with Mexico.

Now, mortgage rates are based on yields on 10-Year treasuries, and the interest rate on bonds tends to drop during times of economic uncertainty. When this occurs, mortgage rates also drop.

My current forecast model predicts that average 30-year mortgage rates will end 2019 at around 4.4%, and by the end of 2020 I expect to see the average 30-year rate just modestly higher at 4.6%.

SOURCE: Windermere Blog

Windermere Celebrates 35 Years of Community Service!

If you try to call or stop by a Windermere office today you’ll notice that we’re closed for business. That’s because the entire Windermere network of agents, franchise owners, and staff are volunteering for our annual Community Service Day. For the past 35 years, our agents have taken one-day-a-year off to dig into hands-on community service projects, volunteering more than one million hours of time in the process.

So, what do we do on Community Service Day? This year, we can be found doing a variety of projects, such as weeding community gardens, cleaning and landscaping at various parks, sorting donations and cleaning up warehouse spaces at local nonprofits, cleaning animal shelters, building and auctioning off Adirondack chairs to benefit school district programs for homeless students, cleaning elementary schools, sorting/distributing food at food banks, preparing land for the growing season at food pantries, and helping to build a playground at a homeless shelter for families. This is just a sample of the projects that our offices have selected to complete on Windermere’s annual day of giving.

Community Service Day is something our company looks forward to every year because it gives us the opportunity to come together as a team to make a positive difference in the communities where we live, work, and play.

SOURCE: Windermere Blog

The Housing Market in 2019

The last time we saw a balanced market was late 1990s, meaning many sellers and buyers have never seen a normal housing market. Windermere Real Estate’s Chief Economist Matthew Gardner looks at more longer-term averages, what does he see for the future of the housing market?

Q1 2019 Matthew Gardner Report

The spring home buying season started early this year. Open houses had increased attendance and bidding wars returned in March. Home prices in most of the region are about even with March of 2018. The Eastside median closed sales price decreased 1% from March 2018 ($831,000) to March 2019 ($825,000).

Months supply of inventory decreased from 1.8 in February 2019 to 1.2 in March 2019, its lowest in nine months. The number of Eastside sales increased 2% for the first quarter 2019 compared to 2018. The speed of the market (percentage of homes sold in two weeks or less, number of multiple offers) is slower than a year ago (arguably a good thing), although it is speeding up.

Eastside Market Review – First Quarter 2019

First Quarter – 2019

The spring home buying season started early this year. Open houses had increased attendance and bidding wars returned in March. Home prices in most of the region are about even with March of 2018. The Eastside median closed sales price decreased 1% from March 2018 ($831,000) to March 2019 ($825,000). Months supply of inventory decreased from 1.8 in February 2019 to 1.2 in March 2019, its lowest in nine months. The number of Eastside sales increased 2% for the first quarter 2019 compared to 2018. The speed of the market (percentage of homes sold in two weeks or less, number of multiple offers) is slower than a year ago (arguably a good thing), although it is speeding up.

Caring for our Communities through the Windermere Foundation

Windermere offices have been busy this year raising money for the Windermere Foundation which provides funding to support low-income and homeless families throughout the Western U.S. Last quarter alone, the Windermere Foundation collected over $308,236 in donations, bringing our total to $38,314,364 raised since 1989 when the Windermere Foundation first started.

Each Windermere office has its own Windermere Foundation fund account that they use to make donations to organizations in their local communities. These accounts are funded by donations from owners, agents, staff, and the community, and from donations through Windermere agent commissions. The Windermere Hillsboro office in Oregon, and Windermere Coeur d’Alene Realty in Idaho, are two great examples of how our offices go above and beyond to support their local communities.

Windermere Hillsboro

Windermere Hillsboro

Earlier this year, the Windermere Hillsboro office donated $1,500 to the Hillsboro School District’s McKinney-Vento program, a program which ensures that students who face housing instability and hardship have access to public education, despite the lack of a fixed living environment or a supervising parent or guardian. There are 20,000 students in the district and more than 400 of those students face housing instability. Every school district in Oregon has at least one designated McKinney-Vento Liaison. The Hillsboro School District has a team of three that works tirelessly to support each student and their families with rental and utilities assistance. If there is housing stability at home, then those students are more likely to stay in school.

The Windermere Hillsboro office also made a $5,000 donation to Community Action, whose mission is to lead the way to eliminate conditions of poverty and create opportunities for people and communities to thrive. The donation will go towards programs that help approximately 26,000 individuals and families: Energy Assistance, Early Childhood Development, Family Development, and Housing Stability.

Windermere/Coeur d’Alene Realty

In March, Windermere/Coeur d’Alene Realty, which has offices in Coeur d’Alene, Post Falls, and Hayden, was recognized as the Best Real Estate Office by The Business Journal of North Idaho in their “Best of 2019” awards. This is the ninth year-in-a-row that they have received this honor. The brokerage was also named Idaho’s Brightest Star for their philanthropy and community involvement. Through the Windermere Foundation, they have given back nearly one million dollars to local charities and humanitarian agencies in Kootenai County, and more than 11,000 warm winter boots to local children in need.

Thanks to our agents, offices, and everyone who supports the Windermere Foundation, we have been able to make a difference in the lives of many families in our local communities. This year we celebrate the Windermere Foundation’s 30th anniversary with a renewed year-long focus on giving back, doing more, and providing service to the communities that have made us who we are.

Our goal for 2019 is to raise over $40 million in total donations. If you’d like to help us reach this goal, or learn more about the Windermere Foundation, please visit WindermereFoundation.com.

Beyond Alexa – Other Smart Appliances You Can Use In Your Home

The nation’s largest home-building company, Lennar, now integrates Amazon’s “Alexa” smart speaker system as a function in new homes they construct. In the United States alone there are reportedly at least 39 million privately owned smart speakers, and the growth seems likely to only continue. With an eye to the future, we decided to shine a light on a few other “smart” products that can help enhance your home.

Smart Doorbells

- While the iconic heavy door-knocker of 19thcentury Victorian may hold its appeal, high-tech doorbells are an increasingly popular option.

- The Amazon-owned Ring Doorbell is the pace-setter for this rapidly growing industry, allowing for remote monitoring of your home via video, two-way talking functionality, and WiFi-connectivity to allow homeowners to keep tabs on their property no matter how far they roam.

- If you’d like to go elsewhere, the market is flush with alternate options. SkyBell’s ringer allows for free cloud storage of video, while the Zmodo Greet Smart model allows for easy installation using your previous doorbell’s hardware, and comes at a price over $100 under most of the notable options.

Smart Refrigerators

- Much has been said of the lamentations regarding the loss in popularity of the family dinner around the table. If your family is drawn to their phones when it’s time to get meals going, a smart refrigerator may be the trick to centering things around the kitchen and dining room again.

- The brands may be familiar but the appliances are all-new. GE, Kenmore, Samsung, and Whirlpool are just a few household names involved in the exciting world of smart appliances.

- The options are wide-ranging in functionality – from Alexa-connected Kenmore smart fridges to Samsung’s full home command center, you can control temperatures in the fridge and in your home, play music and videos, and even pull up recipes on-screen to help your tech-savvy family follow along step-by-step.

Smart Energy Monitors

- Most people like doing things that are energy-efficient, but when it’s financially challenging it’s tough to make that choice. The best products, then, are those that check both boxes.

- Energy monitors like those from Sense, CURB, and Neurio offer the ability to connect into your appliances and circuit board, monitoring energy usage from your smartphone.

- How often are you likely to check your appliances unless they suddenly break down? With these monitors, not only can you maintain appropriate energy usage, you can identify issues before they become disasters.

How to Get Started in Real Estate Investing

Investing in real estate is one of the world’s most venerable pathways to building wealth. When properly managed, income from renting or real estate investment trusts can provide you with the financial security to plan out the rest of your life. The conclusion is easy to envision, but knowing where to begin can be overwhelming, particularly for anyone who has never previously owned a home.

At Windermere our goal is always to improve and support our communities, here are a few key things to keep in mind as you enter the world of real estate investment.

Know the right type of investment for you

Investing in real estate needn’t commit you to being a landlord. A Real Estate Investment Trust (REIT) is a low-maintenance way to get involved in real estate with next to none of the day-to-day monitoring required of direct property management. REITs are trusts that typically own multiple properties, and investors may purchase shares within the REIT. Typically, as the value of the property rises, so too do the values of your shares. If you’d like to dip a toe into real estate investing before diving in fully, a REIT is a great place to start.

Start with your own home

Owning the roof over your head is a basic step towards investing success. Even better, when you plan to live in the home you’re buying (rather than renting it out), you will likely benefit from lower mortgage rates and a cheaper down payment. The reasoning is straightforward – lenders see a loan to people purchasing the home they live in as an investment in people highly committed to the property.

Once you’ve owned your own house for a few years, you can look to purchase a new home to move into. By purchasing the new home with the intent to move in, you’ll be eligible to receive more favorable financing once again. After you’ve secured your new home, your first home is primed to be transformed into a rental property, and you can continue to see a return on your investment.

Cast a wide net

The best investment opportunity isn’t always going to be right underneath your nose. While there are logistical benefits to focusing locally with your investment, you may miss more profitable opportunities in another burgeoning market. Real estate is a long game, and patience tends to be rewarded. There’s no cause to rush a decision of this magnitude, so investigating other states and regions to find the property that best fits your situation is a process worth considering.

Are You Better Off Paying Your Mortgage Earlier or Investing Your Money?

Photo Credit: Rawpixel via Unsplash

Few topics cause more division among economists than the age-old debate of whether you’re better off paying off your mortgage earlier, or investing that money instead. And there’s a good reason why that debate continues; both sides make compelling arguments.

For many people, their mortgage is the largest expense they will ever incur in their lives. So if given the chance, it only makes logical sense you would want to pay it off as quickly as possible. On the other hand, a mortgage is also the cheapest money you will ever borrow, and it’s generally considered good debt. Any extra money you obtain could be definitely be put to good use elsewhere.

The reality is, however, a little less cut and clear. For some homeowners, paying off their mortgage earlier is the right answer. While for others, it would be far more advantageous to invest their money.

Advantages of paying off your mortgage earlier

- You’ll pay less interest: Each time you make a mortgage payment, a portion is dedicated towards interest, and another towards principal (we’ll ignore other costs for now). Interest is calculated monthly by taking your remaining balance, the length of your amortization period, and the interest rate agreed upon with your lending institution.

If you have a $300,000 mortgage, at a 4% fixed rate over 30 years, your monthly payment would be around $1,432.25. By the time you finish paying off your mortgage, you would have paid a total of $515,609, of which $215,609 were interest.

If you wanted to lower the total amount you pay on interest, you don’t need to make a large lump sum to make a difference. If you were to increase your monthly mortgage payment to $1,632.25 (a $200 a month increase), you would be saving $50,298 in interest, and you’ll pay off your mortgage 6 years and 3 months earlier.

Though this is an oversimplified example, it shows how even a small increase in monthly payments makes a big difference in the long run.

- Every additional dollar towards your principal has a guaranteed return on investment: Every additional payment you make towards your mortgage has a direct effect in lowering the amount you pay in interest. In fact, each additional payment is, in fact, an investment. And unlike stocks, bonds, and other investment vehicles, you are guaranteed to have a return on your investment.

- Enforced discipline: It takes real commitment to invest your money wisely each month instead of spending it elsewhere.

Your monthly mortgage payments are a form of enforced discipline since you know you can’t afford to miss them. It’s far easier to set a higher monthly payment towards your mortgage and stick to it than making regular investments on your own.

Besides, once your home is completely paid off, you can dedicate a larger portion of your income towards investments, your children or grandchildren’s education, or simply cut down on your working hours.

Advantages of investing your money

- A greater return on your investment: The biggest reason why you should invest your money instead comes down to a simple, green truth: there’s more money to be made in investments.

Suppose that instead of dedicating an additional $200 towards your monthly mortgage payment, you decide to invest it in a conservative index fund which tracks S&P 500’s index. You start your investment today with $200 and add an additional $200 each month for the next 30 years. By the end of the term, if the index fund had a modest yield of 5% per year, you will have earned $91,739 in interest, and the total value of your investment would be $163,939.

If you think that 5% per year is a little too optimistic, all we have to do is see the S&P 500 performance between December 2002 and December 2012, which averaged an annual yield of 7.10%.

- A greater level of diversification: Real estate has historically been one of the safest vehicles of investment available, but it’s still subject to market forces and changes in government policies. The forces that affect the stock and bonds markets are not always the same that affect real estate, because the former are subject to their issuer’s economic performance, while property values could change due to local events.

By putting your extra money towards investments, you are diversifying your investment portfolio and spreading out your risk. If you are relying exclusively on the value of your home, you are in essence putting all your eggs in one basket.

- Greater liquidity: Homes are a great investment, but it takes time to sell a home even in the best of circumstances. So if you need emergency funds now, it’s a lot easier to sell stocks and bonds than a home.

Q4 2018 Matthew Gardner Report

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions.

ECONOMIC OVERVIEW

The Washington State economy continues to add jobs at an above-average rate, though the pace of growth is starting to slow as the business cycle matures. Over the past 12 months, the state added 96,600 new jobs, representing an annual growth rate of 2.9% — well above the national rate of 1.7%. Private sector employment gains continue to be quite strong, increasing at an annual rate of 3.6%. Public sector employment was down 0.3%. The strongest growth sectors were Real Estate Brokerage and Leasing (+11.4%), Employment Services (+10.3%), and Residential Construction (+10.2%). During fourth quarter, the state’s unemployment rate was 4.3%, down from 4.7% a year ago.

My latest economic forecast suggests that statewide job growth in 2019 will still be positive but is expected to slow. We should see an additional 83,480 new jobs, which would be a year-over-year increase of 2.4%.

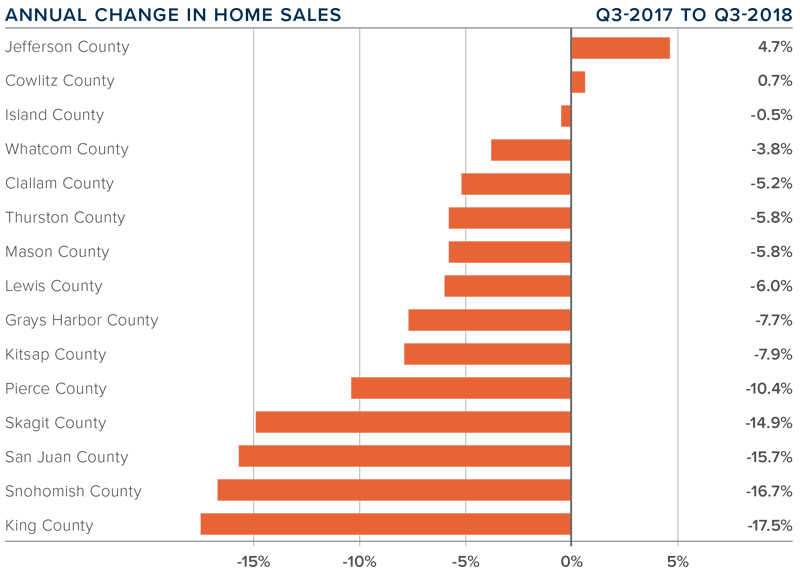

HOME SALES ACTIVITY

-

There were 17,353 home sales during the fourth quarter of 2018. Year-over-year sales growth started to slow in the third quarter and this trend continued through the end of the year. Sales were down 16% compared to the fourth quarter of 2017.

-

The slowdown in home sales was mainly a function of increasing listing activity, which was up 38.8% compared to the fourth quarter of 2017 (continuing a trend that started earlier in the year). Almost all of the increases in listings were in King and Snohomish Counties. There were more modest increases in Pierce, Thurston, Kitsap, Skagit, and Island Counties. Listing activity was down across the balance of the region.

-

Only two counties—Mason and Lewis—saw sales rise compared to the fourth quarter of 2017, with the balance of the region seeing lower levels of sales activity.

-

We saw the traditional drop in listings in the fourth quarter compared to the third quarter, but I fully anticipate that we will see another jump in listings when the spring market hits. The big question will be to what degree listings will rise.

HOME PRICES

-

With greater choice, home price growth in Western Washington continued to slow in fourth quarter, with a year-over-year increase of 5% to $486,667. Notably, prices were down 3.3% compared to the third quarter of 2018.

-

Home prices, although higher than a year ago, continue to slow. As mentioned earlier, we have seen significant increases in inventory and this will slow down price gains. I maintain my belief that this is a good thing, as the pace at which home prices were rising was unsustainable.

-

When compared to the same period a year ago, price growth was strongest in Skagit County, where home prices were up 13.7%. Three other counties experienced double-digit price increases.

-

Price growth has been moderating for the past two quarters and I believe that we have reached a price ceiling in many markets. I would not be surprised to see further drops in prices across the region in the first half of 2019, but they should start to resume their upward trend in the second half of the year.

DAYS ON MARKET

-

The average number of days it took to sell a home dropped three days compared to the same quarter of 2017.

-

Thurston County joined King County as the tightest markets in Western Washington, with homes taking an average of 35 days to sell. There were eight counties that saw the length of time it took to sell a home drop compared to the same period a year ago. Market time rose in five counties and was unchanged in two.

-

Across the entire region, it took an average of 51 days to sell a home in the fourth quarter of 2018. This is down from 54 days in the fourth quarter of 2017 but up by 12 days when compared to the third quarter of 2018.

-

I suggested in the third quarter Gardner Report that we should be prepared for days on market to increase, and that has proven to be accurate. I expect this trend will continue, but this is typical of a regional market that is moving back to becoming balanced.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I am continuing to move the needle toward buyers as price growth moderates and listing inventory continues to rise.

2019 will be the year that we get closer to having a more balanced housing market. Buyer and seller psychology will continue to be significant factors as home sellers remain optimistic about the value of their home, while buyers feel significantly less pressure to buy. Look for the first half of 2019 to be fairly slow as buyers sit on the sidelines waiting for price stability, but then I do expect to see a more buoyant second half of the year.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

This article originally appeared on the Windermere.com blog.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link